Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- A collection of positive and negative news that affects the foreign exchange mar

- The U.S.-European trade prospects suppress gold prices, and the impact of the U.

- A collection of positive and negative news that affects the foreign exchange mar

- Economic data helps pound, but short-term technical needs to be vigilant about p

- Powell cut interest rates in September vs. the RBA "stand still", with a long an

market news

The Fed's hawks "awaken"! International trade sentiment improves, gold continues to fluctuate

Wonderful introduction:

Since ancient times, there have been joys and sorrows of parting, and since ancient times, there have been sad songs about the moon. It’s just that we never understood it and thought everything was just a distant memory. Because without real experience, there is no deep inner feeling.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: The Federal Reserve hawks "awaken"! International trade sentiment improves, and gold continues to tremble." Hope this helps you! The original content is as follows:

This week’s market began with a series of potential risks, but with the efforts of all parties, these risks were resolved one by one, and market sentiment temporarily turned positive.

This week, international spot gold and silver closed at US$4,003.23 and US$48.68 per ounce respectively, down 2.65% and up 0.19% respectively. Gold and silver monthly lines recorded three consecutive gains and six consecutive gains respectively. Some key points of the key trade deal were agreed upon, averting market concerns. The meeting in South Korea did deliver results and was welcomed by market participants, but it also set the stage for new uncertainties.

The crude oil market is generally weak. In the first half of the week, oil prices continued to decline due to expectations that OPEC+ would increase production and ease supply. EIA data showed that inventory declines and US sanctions on Russian oil stimulated a slight rebound in oil prices, but the intensity was limited.

On Friday, US media reported that the United States was about to launch a military attack on Venezuela, and oil prices rose on hearing the news. Trump denied that he had decided to launch strikes against military targets in Venezuela, contradicting earlier media reports that he had approved the strikes.

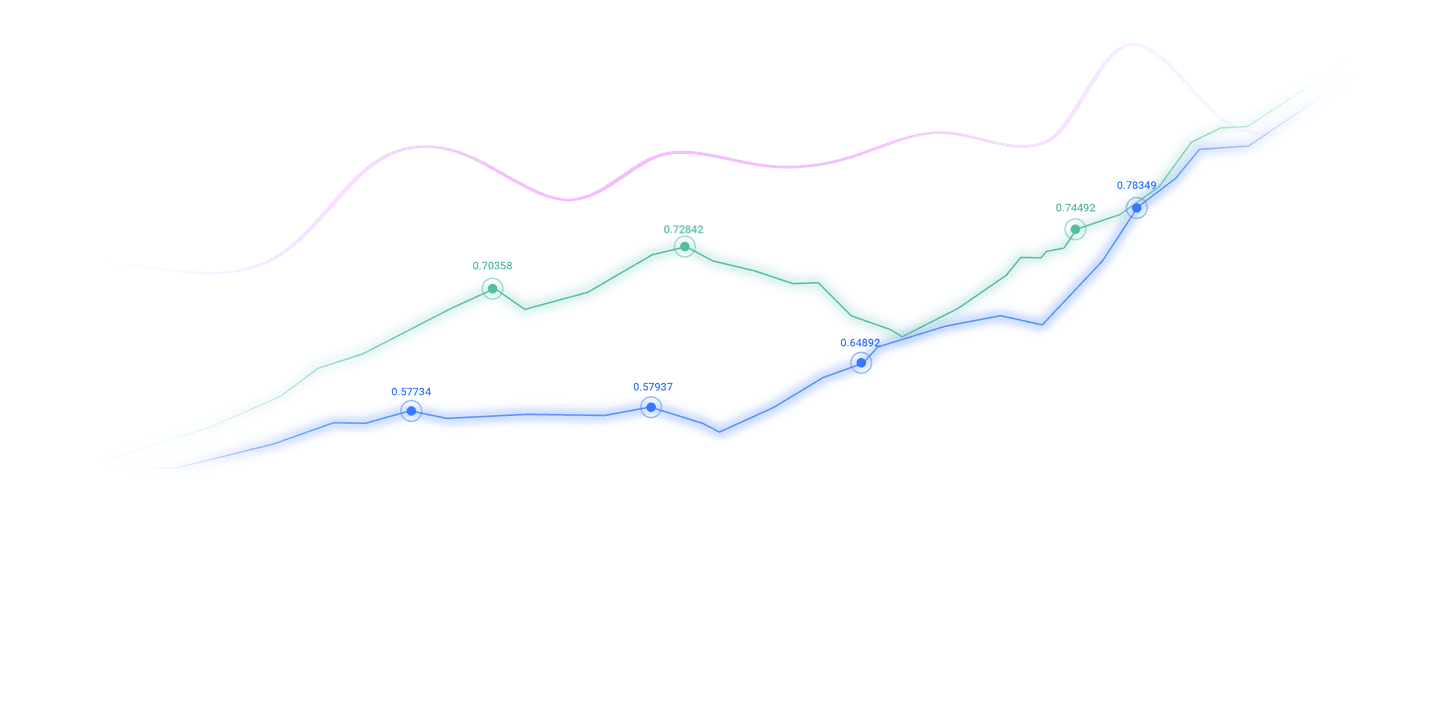

The U.S. dollar benefited from the Federal Reserve's hawkish outlook, with the U.S. dollar index rising to a two-month high. Looking at Friday's market performance, the yen is heading for its worst monthly decline against the dollar since July. This was largely because the Bank of Japan disappointed traders hoping for a clearer hint of a rate hike, while the Federal Reserve also lowered market expectations for a rate cut in December.

Meanwhile, the European Central Bank kept interest rates unchanged and said its policy was in "good shape." Affected by the general strength of the US dollar, the euro has fallen by 0.79% this month. Finally, the pound fell to its lowest level since April against the dollar and hit its lowest level since 20 against the euro.The weakest level since May 2023, mainly due to the increasing political pressure on British Chancellor of the Exchequer Reeves.

Foreign exchange market:The U.S. dollar index generally showed a trend of strengthening after shocks this week. At the beginning of the week, it fluctuated continuously due to improved trade expectations and market wait-and-see sentiment, and then rose strongly after Powell issued a hawkish signal that a December interest rate cut was not certain. It closed at 99.7 on Friday, up 0.77%.

Gold Market: The precious metal continues to experience significant volatility this week. At the beginning of the week, a drop in risk aversion triggered a sell-off. Spot gold once plunged more than 3% in a single day, falling below the US$4,000 mark and testing a three-week low. Subsequently, the price of gold has repeatedly seen seesaws, and the market believes that conflict risks and policy uncertainty still exist. The trend of silver is slightly different. After falling at the beginning of the week, the European market began to rise in shock on Tuesday. This week, gold and silver closed at US$4,003.23 and US$48.68 per ounce respectively, down 2.65% and up 0.19% respectively. Gold and silver monthly lines recorded three consecutive gains and six consecutive gains respectively.

Crude oil market: The crude oil market is overall weak. In the first half of the week, oil prices continued to decline due to expectations that OPEC+ would increase production and ease supply. EIA data showed inventory declines and US sanctions on Russian oil stimulated a slight rebound, but the intensity was limited. On Friday, US media reported that the United States was about to launch a military attack on Venezuela, and oil prices rose on the news.

Review of this week’s headlines 1. The Federal Reserve cut interest rates but released a hawkish signal, leaving policy variables in December The Federal Reserve cut interest rates by 25 basis points this week to 3.75%-4.00%, and announced that it would end its balance sheet reduction on December 1. However, Powell hinted at the press conference that he may not continue to cut interest rates in December, emphasizing data dependence and internal policy differences. The two officials voted against the resolution, highlighting the divisions within the Fed. Market expectations for the probability of an interest rate cut in December have dropped from 83% to 65%, and interest rates are expected to rise to 3.04% by the end of next year. Finance Minister Bessant criticized the Fed's conservative attitude, and Trump once again criticized Powell and said that a new chairman would be selected as soon as possible. 2. China-U.S. economic and trade consultations reached a phased consensus China and the United States reached a number of agreements after the talks in Kuala Lumpur: the United States suspended some tariffs and export control measures against China, and China adjusted countermeasures accordingly and suspended export restrictions. The two sides agreed to extend tariff exclusion and promote cooperation in agricultural products trade and fentanyl drug control. The United States promises to provide an open environment in the investment field, and the TikTok issue will be further negotiated. 3. The U.S. government shutdown is one month old, and negotiations are still at an impasse The federal government shutdown has lasted for a month. The Republicans have proposed a variety of temporary funding plans, but the Democrats have not yet www.xn--xm-5s9cx14e.compromised. The key differences between the two parties focus on issues such as medical subsidies. The shutdown has caused $18 billion in economic losses and hindered the release of labor data. ADP announces the release of weekly employment data to fill the information gap. 4. Trump’s visit to Japan strengthens the US-Japan alliance Trump and JapanPrime Minister Takaichi Sanae met and the two parties signed a rare earth cooperation agreement and confirmed the 15% tariff agreement. Trump pledged support for Japan, gave Japan gifts and nominated it for the Nobel Prize. Multilateral diplomatic interactions between the United States, Japan and South Korea are advancing simultaneously, and the United States and South Korea have signed a US$350 billion trade and defense agreement. 5. The Palestinian-Israeli conflict resumed, and the ceasefire agreement was frustrated Israel airstrikes in Gaza, Hamas handed over the remains, and both sides accused each other of violating the ceasefire. Netanyahu emphasized that the goal of disarming Hamas remains unchanged, and the United States called for maintaining the ceasefire but supported Israel's right to self-defense. Regional tensions have escalated again. 6. The China Financial Street Forum clarified the policy direction Pan Gongsheng, governor of the Central Bank, proposed to adhere to a prudent monetary policy, resume treasury bond trading operations, and deepen the application of digital renminbi. The State Administration of Financial Supervision emphasizes serving the real economy, and the China Securities Regulatory www.xn--xm-5s9cx14e.commission will promote the reform of the GEM and expand institutional opening up. 7. The relationship between the United States and Russia is tense, and the United States has restarted nuclear tests Trump canceled the Budapest summit with Putin in response to Russia’s tough stance on Ukraine. The United States imposed sanctions on Russian energy www.xn--xm-5s9cx14e.companies, and Trump announced the resumption of nuclear tests, triggering international concern. The US military has strengthened its military deployment around Venezuela. 8. The Bank of Japan and the European Central Bank stayed on hold, Canada cut interest rates The Bank of Japan kept interest rates unchanged, and review www.xn--xm-5s9cx14e.committee members were divided on raising interest rates. The European Central Bank kept its benchmark interest rate unchanged at 2% for the third consecutive time, and Lagarde said the policy position was appropriate. The Bank of Canada cut interest rates by 25 basis points and lowered its growth forecast. The above content is all about "[XM Foreign Exchange Market Analysis]: The Fed hawks are "awakening"! International trade sentiment has improved, and gold has continued to tremble." It was carefully www.xn--xm-5s9cx14e.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support! Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here